INC-29: Single-Form Company Registration

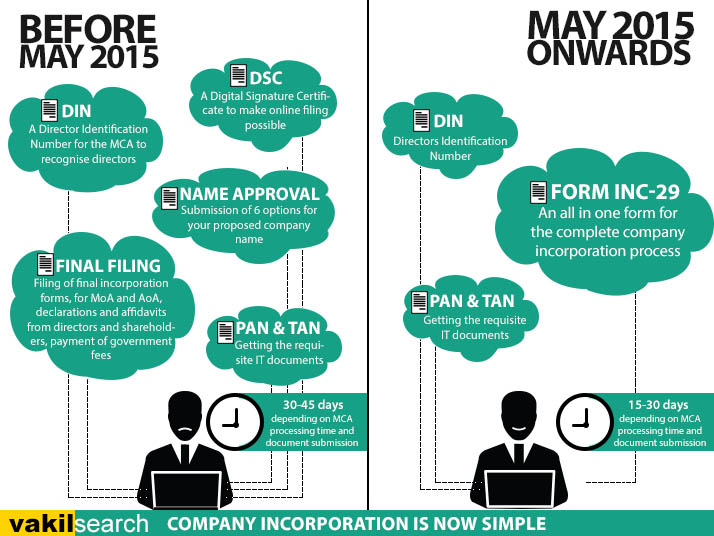

The business of starting a company is finally about to get easier for Indian entrepreneurs. This is on account of the introduction of an integrated form, known as INC-29, which could reduce the processing time for company registration to as little as 48 hours according to the MCA. While this is unlikely to be fulfilled, for several reasons we’ll address in this post, the initiative is definitely a move in the right direction and should severely shorten the current 30- to 45-day registration process. Let’s examine all the changes in detail:

What is INC-29?

It is a form introduced by the MCA in May 2015 to simplify the registration process. It combines forms for Director Information Number (DIN), name approval and incorporation into one. So while under the old process (which can still be used, by the way) the DIN was required before name approval could begin and incorporation could begin only once the name was approved, all three will now be processed simultaneously.

How much time will it save?

It’s impossible to give an exact number of days. In any case, it’s likely to vary quite significantly from case to case. Here’s why:

Old procedure: Takes 30 to 45 days to complete. This can be broken down as follows: Digital Signature Certificate (DSC; 2 to 5 working days), DIN (1 to 3 working days), Name Approval (4 to 15 working days), Final Incorporation Filings (7 to 15 working days) and PAN & TAN (7 working days).

New Procedure: DSC will continue to take 2 to 5 working days. The DIN, Name Approval and Final Incorporation Filings, though submitted simultaneously, are likely to be processed separately. This means that processing time, though shorter than in the old procedure, is likely to be much longer than the government claim of 48 hours. Our estimate is 15 to 30 days.

Will it be cheaper?

Yes. Surprisingly, the INC-29 process not only promises to be cheaper, it will reduce the cost of the incorporation process. The old forms had a total cost of Rs. 4200, whereas the new form will cost just Rs. 2000.

How to incorporate with INC-29?

Step 1 – Get a DSC

A Digital Signature Certificate (DSC) is necessary so that the company registration process can be completed electronically. One proposed director must get a Class-2 DSC. It is the digital equivalent of a physical certificate, stored on a USB token.

The DSC can be obtained from one of the six government-certified vendors, such as Tata Consultancy Services and nCode. Their prices vary from Rs. 400 to Rs. 2650. To get one, what you need is a self-attested copy of the director’s PAN card and address proof (latest utility bill, passport, driver’s license of voter’s ID). This can be completed in 2 days.

Step 2 – Get Papers in Order

Even while waiting for the DIN, you could begin with getting the papers in order for filing INC-29. This is because every attachment for the incorporation process needs to be filed along with this single form. Moreover, you’ll get only one attempt to resubmit the same. So if you make a mistake once the Registrar has already pointed out what’s wrong with your application, you’ll have to start filing INC-29 again. Even more painfully, you may have to apply for a refund on the government fees you paid the first time.

So here are the documents you need to get in order for (all documents need to be self-attested; in case of a foreign director, they would need to be notarised at the Indian embassy):

- Director Identification Number: The Director Identification Number (DIN) is how the MCA identifies directors of companies. A single director can have only one. Up to three directors, including the one with the DSC, may apply for a Director Identification Number (DIN) through INC-29; the rest, if any, should do so separately (the old procedure allows for an unlimited number of applications). The documents needed are the same as for the DSC, but you’ll also need to provide a Passport-sized photograph of each applicant.

- Name Reservation: You need to come up with one – yes, just one – name. While the old procedure allows for submission of six, the new allows just one. So you have to be careful while picking the name. To do so, you should follow the naming guidelines provided by the MCA. This means that the name should not have been taken by another private limited company and there shouldn’t be a registered trademark with the same name. Also, you should ensure that your name contains a unique word and a word that describes the sector you’re in (Arlem Catering Services Private Limited, for example). The INC-29 form also asks for the significance of the name you’re picking. Here you must explain how the name of your company connects with the business you’re in.

- Memorandum and Articles of Association – The Memorandum of Association (https://www.startupfreak.com/memorandum-of-association-and-its-clauses/) and Articles of Association (https://www.startupfreak.com/what-is-aoa-articles-of-association/) need to be attached to the INC-29. You would need a Company Secretary to sign these documents.

- Registered Office Verification – You have to upload a soft copy of a Rental Agreement, along with a no-objection certificate from the owner. If the business owns the property, then the sale deed would need to be submitted.

- Appointment Letters and Declarations – Letters of appointment of directors, CEO, managers, declaration by first director in INC-9 and by appointee and managing director in DIR-2.

Step 3 – Filing of INC-29

Once you’re ready with all the documents, you can file the INC-29. Ensure that all the details are properly filled. After all, you only have one opportunity to resubmit your documents. On filing the document, you will be directed to pay the fees and stamp duty. The fees will depend on the authorised capital and the state in which the company is being registered (Punjab and Kerala, for example, have much higher stamp duty rates). Depending on the workload of the MCA, completeness of applicaiton and the complexity of your business, you will receive the Certificate of Incorporation within 10 to 25 days. The form does seem to indicate that PAN and TAN would also be approved in INC-29, but this is not the case; you still need to apply separately.

Step 4 – Get PAN & TAN

All companies need a Permanent Account Number, to be registered with the IT Department, and Tax Account Number, for depositing tax deducted at source. To get these documents, you must first apply at the NSDL website and then submit copies of the Certificate of Incorporation, along with the signature of the main director and company seal. You will receive the documents in 7 working days at the registered office address. The cost of these is Rs. 109 and Rs. 67 for PAN and TAN, respectively.

What are the concerns with INC-29?

No Track: As all the processes are combined, you will have no idea where your form is stuck. It could be stuck at name approval, DIN, or incorporation. In the absence of a tracking system, you just have to wait until the file is returned.

Single Name: The Registrar tends to take over 7 working days to approve names under the old process, even though it has the liberty to pick any one from six options. Under the new process, where only one may be submitted, rejections seem bound to happen because of the proposed name.

Single Resubmission: Some of the registration process is still so subjective that a single resubmission is not enough. The name approval process, for example, is completely at the whim of the Registrar. It’s possible for your name to be rejected more than once, in which case you would have to file the form and pay the Rs. 2000 again.

Even with INC-29, company registration remains a tedious process, as the MCA has not dropped any submissions, merely combined them. The total cost will depend on the cost of company secretary you choose.

[Guest article by Vakilsearch] Startup Freak Community for entrepreneurs and small businesses

Startup Freak Community for entrepreneurs and small businesses